What Ails Poultry in India

The Indian poultry industry, comprising production and consumption of eggs and poultry meat, has fallen far short of global averages and baffled industry watchers. Initially from the 1970s when Dr. Rao put this industry on structured lines, there was rapid growth, but for the past three decades, progress has fallen short of expectations. Many hypotheses have been put forward to explain this. My analysis examines the driving factors and comes up with some not-so-obvious conclusions and remedies.

PPP and Vegetarianism

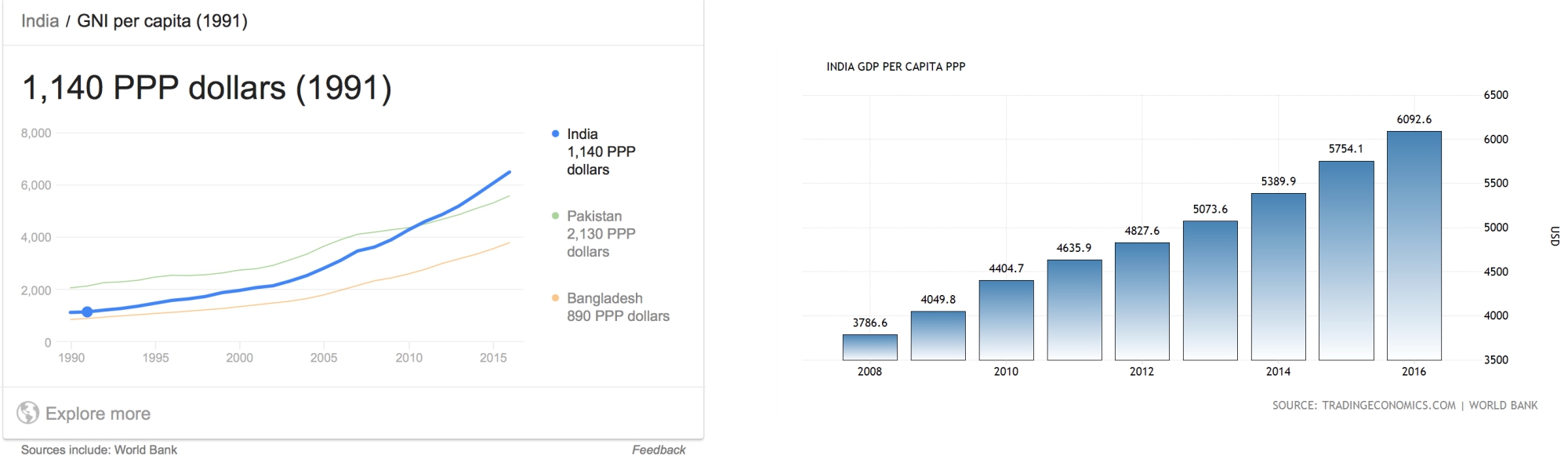

Indian per capita purchasing power parity rose from $1173 to 6092 (reference 1) over the 1991-2016 period of 25 years – a straight 16.8% per annum growth rate. But poultry consumption rose from a per capita of 3 kilograms to just under 6 (reference 2), registering a growth of only 4% per annum in this period. The growth of the table egg market has likewise been lack lustre. Has India reached a saturation level of poultry consumption at these levels of PPP? Were this true, it would be borne out by examining the consumption levels of other countries at these income levels. When we do so, we find India remains a laggard.

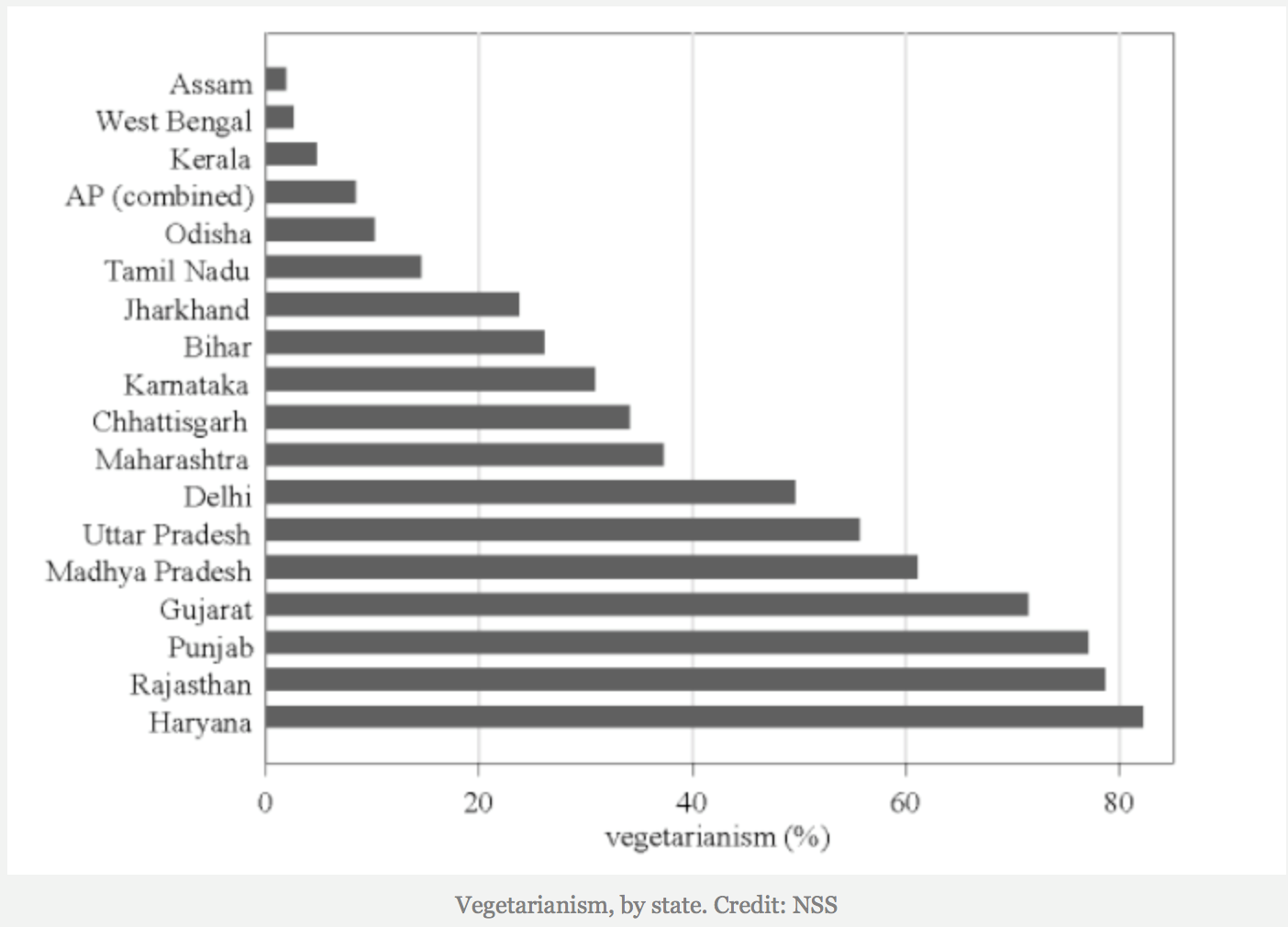

On the other hand, the oft-trotted claim that Indian figures for PPP versus poultry consumption are not comparable with other countries because of the largely vegetarian nature of her population also needs close examination.

According to the 2006 Hindu-CNN-IBN State of the Nation Survey, 31% of Indians are vegetarians, while another 9% consume eggs. The remaining 60% qualify as non-vegetarians who consume meat and eggs. Other surveys cited by FAO and USDA estimate 20%–42% of the Indian population as being vegetarian. These surveys indicate that even Indians who do eat meat, do so infrequently, with less than 30% consuming it regularly, although the reasons are mainly cultural and partly economic. Thirty per cent of 1.3 billion (400 million) is still a huge population, comparable to the combined population of the Philippines, Vietnam, Angola, the Republic of Congo and Myanmar, (each of which consumes large quantities of other meats as well, unlike India) and has PPP per capita income comparable to India with per capita poultry consumption ranging between 11 and 22 kg per annum (reference 3).

Hindu-CNN-IBN data is conservative. A Wire magazine article, What India Really Eats dated March 5, 2018 reviews three other surveys. Large geographical differences exist in food habits, as the article goes on to reveal (reference 4).

| Document | % Vegetarians |

| NSS (2011-12) | 37% |

| NFHS (2005-6) | 37% |

| IHDS (2011-12) | 37% |

These statistics help me to state that in 2011, assuming these five countries to have reached their potential level of per capita poultry meat consumption at a weighted average of 16.7 kilograms, Indian consumption had hovered around a low 41% of its potential, thanks to supply-side constraints!

World Bank – India / GNI per capita (1991) and Tradeconomics.com

Author’s own estimates, posted from time to time on www.aptec.in

Reference 3

| Philippines | $ 8200 | 106 mn | 11 kg |

| Vietnam | $ 6900 | 96 mn | 15.6 kg |

| Rep of Congo | $ 6700 | 8.4 mn | 22.3 kg |

| Angola | $ 6800 | 31 mn | 15.3 kg |

| Myanmar | $ 5900 | 53 mn | 22.1 kg |

Total population 370 mn. Ref: per capita poultry meat consumption -Helgi Library (2011 data); PPP – CIA.

Why This Slow Growth?

Having demonstrated with these statistics that neither low purchasing power nor the prevalence of vegetarianism is sufficient to explain this low 4% per annum growth in consumption of poultry in India, we need to discover what factors could have conspired to do so. India does not import poultry. Therefore, supply-side factors such as availability alone may hold the answer. The abundance of good breeding stock, availability of feed ingredients at global prices and acquisition of global markets (to ensure rapid growth) are secondary factors affecting the supply side. These are manageable by the government of the day if it perceives the role of these secondaries and is motivated to tackle them.

In my view, there are only two limiting factors to the growth of poultry in India. These are

- a disconnect from global trade and

- non-adoption of GM maize and soybean which are the main ingredients of poultry feed.

Both these factors have helped create a manageable monopoly for breeding stock and deterrence of competition from global players that would have led to improved efficiencies and, consequently to employment and growth.

What Public Action Can Change This Scenario?

To break out of this trap, we need to bring in more investment and dismantle market protection. If a monopoly exists, it can be broken by adopting the WTO recommendations of lowering tariff barriers and allowing overseas investments. The Indian poultry industry is neither nascent nor in need of protection. The fresh investment will create more jobs and discourage sponsored advocacy against the adoption of GM crops.

Can we expect these steps to be taken by the indigenous industry? No, of course not. One can hardly expect existing players to voluntarily dilute their hold on the market. Action must be state-sponsored.

Although following the ugly cow vigilantism exhibited by vegetarian goons, fresh thinking about the status and future of the meat industry as a whole has recently begun in the government, I expect we are too close to general elections for a clear policy to be formulated and adopted. I believe that a fresh policy may arrive in 2020 after the electoral dust settles and a new government gets sworn in.

Calculations

Regular meat eaters in India (% in 2006, vide Hindu-CNN-IBN State of the Nation Survey) being 30% of the 2006 population of India = 1162 million. So the number of regular meat eaters is 1162×30% = 349 million

Weighted average consumption per capita annum of five countries in 2011 (11×106+15.6×96+22.3×84+15.3×31+22.1×53)/370 or 1166+1497.6+1873.2+474.3+1171.3 = 6182.4/370 = 16.7 per capita annum consumption of poultry meat in the combined population of meat eaters in these five countries

The population in India in 2011 was 1250 million. Consumption of poultry, assuming that in India 348.6 million regular meat-eating people in 2006 were consuming poultry as in these five countries, should be = 16.7×375 million = 6263 million kilograms

There are 30% more persons in India who consume meat occasionally, according to the Hindu report. Assuming that these persons consume 1/4 of the meat consumed by regular meat eaters, the poultry meat consumption by this segment is 6263/4 = 1566 million kilograms.

Therefore, potential poultry meat consumption in India in 2011 ought to have been 6263+1566 =7829 kilograms.

According to Index Mundi ,broiler meat production in India in 2011 was 2900 million kilograms. However, this statistic does not cover backyard poultry and layer culls which I assume as being 10% of broiler meat.

This, therefore, makes the total poultry meat consumption in India in 2011 as 3190 million kilograms.

In conclusion, the Indian poultry consumption in 2011 ought to have been 7763 kilograms assuming these five countries as standard poultry meat consumers, (because there was no restriction of import) India’s consumption was 3190/7829 = 41% of its potential.

I have made many assumptions here: parity of propensity to consume poultry meat in 6 countries, ignoring price elasticity between poultry and other meats (red meat, fish) on the consumption of poultry meat, comparison of 2006 food habits in India with the present, occasional meat eaters consuming ¼ the quantity consumed by regular meat eaters, horizontal spread of PPP on total population, assuming parity of habit between 2006 and 2011, etc. It is difficult to get all data for these factors. However, in a proper, detailed and scientific study compensating for these, the factor of 41% would fall further in favour of my conclusion.

News

Turnkey Engineering Services

Aptec Joins a Consortium Offering Turnkey Engineering ServicesAptec recently joined a consortium headed by Le Bat of Kuala Lumpur, Malaysia to offer turnkey engineering services to the livestock industry in India and abroad. Other members of the consortium include...

Aptec Widens Client Base

Includes Equipment ManufacturersWith effect from April 2023, Aptec is ready to offer comprehensive engineering services for slaughterhouses and related projects either in association with principal equipment vendors or as a consultant deputed by the promoter of the...

The Poker Game

The reduction of import tariffs on high-end motorcycles in India has been matched by the US raising barriers on H-1B visas. A ding-dong battle has started for the reduction of tariff barriers that prevent US entry into the more lucrative field of poultry, among...